What Does Clark Wealth Partners Do?

Wiki Article

The Clark Wealth Partners PDFs

Table of ContentsGetting The Clark Wealth Partners To WorkGetting My Clark Wealth Partners To WorkThe Of Clark Wealth PartnersFacts About Clark Wealth Partners UncoveredThe Ultimate Guide To Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyThe Ultimate Guide To Clark Wealth Partners

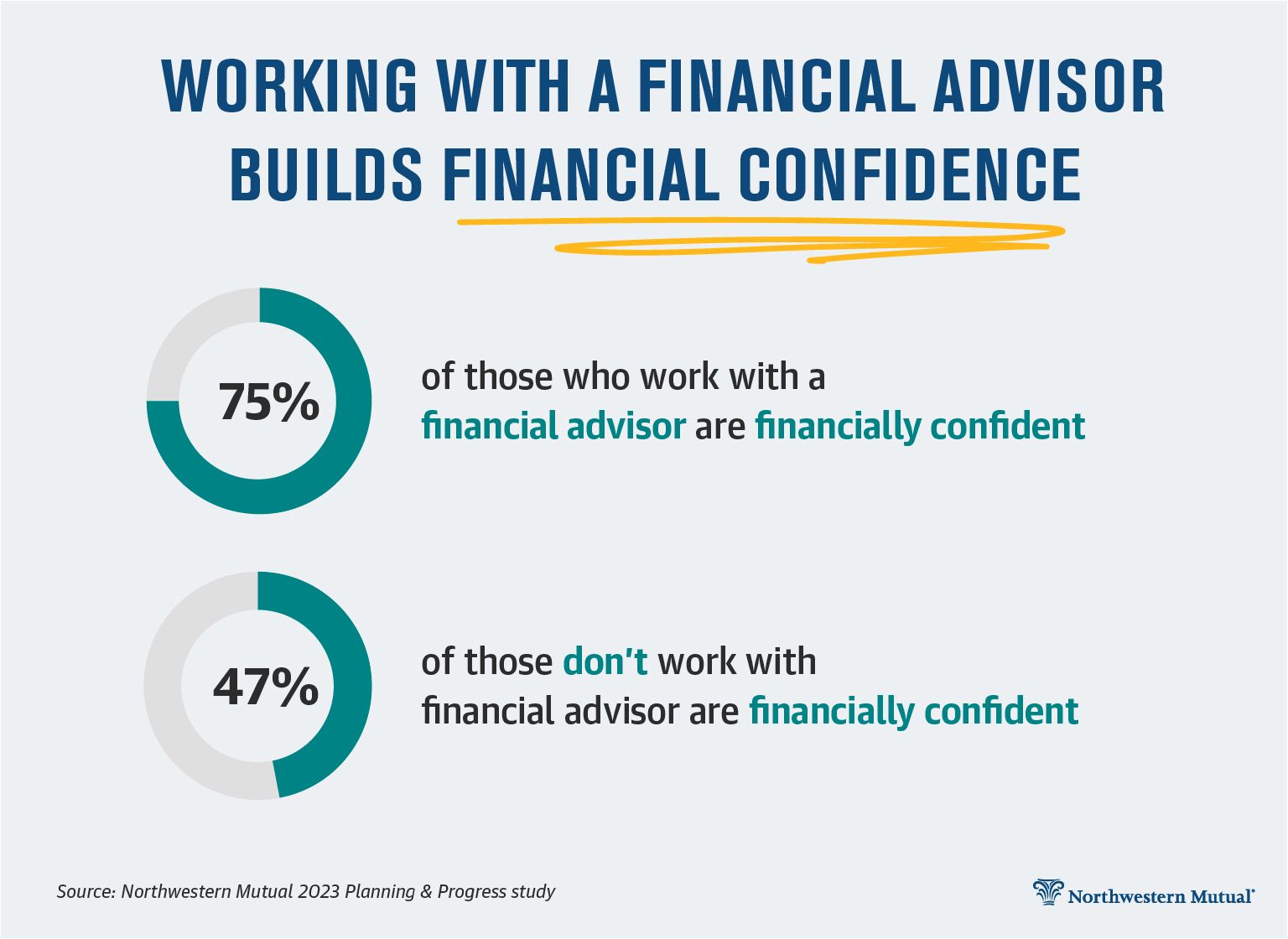

The world of financing is a complicated one. The FINRA Structure's National Capacity Study, as an example, lately found that virtually two-thirds of Americans were incapable to pass a basic, five-question monetary proficiency test that quizzed participants on subjects such as interest, financial debt, and other relatively standard concepts. It's little wonder, then, that we usually see headings regreting the bad state of the majority of Americans' funds (financial advisor st. louis).In addition to handling their existing clients, financial advisors will certainly commonly invest a fair amount of time every week conference with potential customers and marketing their services to retain and expand their company. For those thinking about coming to be an economic consultant, it is necessary to think about the ordinary salary and job stability for those operating in the area.

Programs in taxes, estate planning, investments, and danger monitoring can be valuable for pupils on this path too. Depending on your distinct occupation goals, you might likewise require to earn certain licenses to meet particular clients' needs, such as dealing supplies, bonds, and insurance policy plans. It can likewise be practical to gain a certification such as a Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS).

The Main Principles Of Clark Wealth Partners

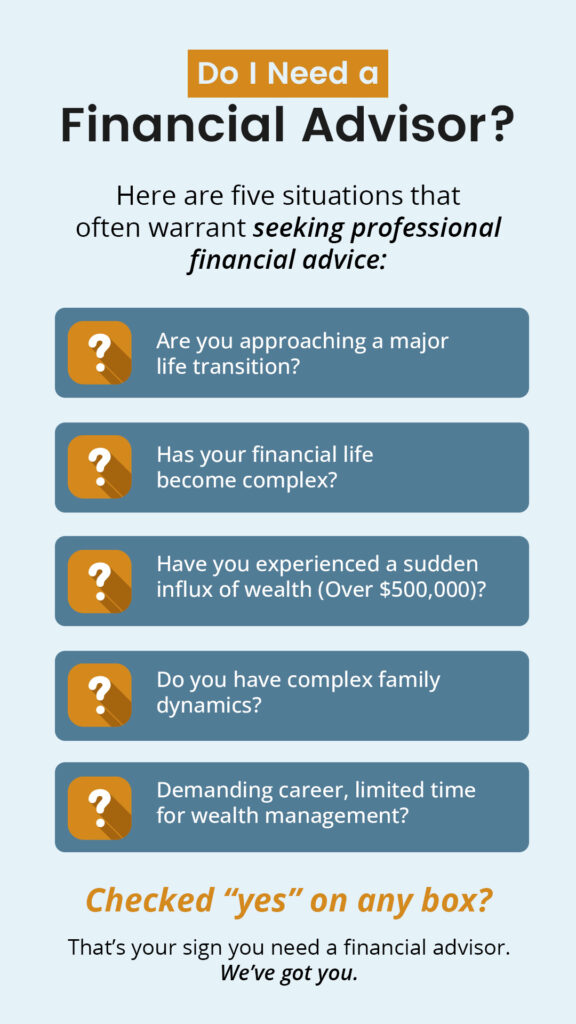

What that looks like can be a number of things, and can vary depending on your age and phase of life. Some individuals worry that they need a specific amount of cash to invest before they can get help from an expert (financial company st louis).

The Best Strategy To Use For Clark Wealth Partners

If you haven't had any kind of experience with an economic advisor, below's what to anticipate: They'll begin by offering a comprehensive analysis of where you stand with your assets, obligations and whether you're fulfilling standards compared to your peers for cost savings and retired life. They'll examine short- and long-term objectives. What's valuable about this step is that it is customized for you.You're young and functioning full time, have a vehicle or 2 and there are trainee finances to pay off.

The Single Strategy To Use For Clark Wealth Partners

You can discuss the following best time for follow-up. Before you start, inquire about pricing. Financial experts generally have different tiers of prices. Some have minimal property levels and will charge a fee usually several thousand bucks for producing and readjusting a strategy, or they may charge a flat cost.

You're looking ahead to your retirement and assisting your kids with greater education and learning prices. A monetary advisor can use guidance for those situations and even more.

More About Clark Wealth Partners

That could not be the most effective method to keep structure wide range, specifically as you progress in your profession. Arrange regular check-ins with your organizer to fine-tune your plan as required. Stabilizing cost savings for retired life and university prices for your youngsters can be challenging. An economic expert can aid you focus on.Thinking around when you can retire and what post-retirement years could resemble can create problems regarding whether your retired life financial savings remain in line with your post-work strategies, or if you have actually saved enough to leave a legacy. Assist your monetary expert comprehend your approach to money. If you are more conventional with conserving (and prospective loss), their ideas must reply to your concerns and worries.

redirected here

The Only Guide to Clark Wealth Partners

Intending for health care is one of the big unknowns in retirement, and a monetary specialist can detail options and recommend whether extra insurance policy as protection may be useful. Prior to you begin, try to get comfy with the concept of sharing your whole financial image with an expert.Offering your specialist a complete photo can help them produce a strategy that's focused on to all parts of your financial condition, particularly as you're rapid approaching your post-work years. If your financial resources are simple and you have a love for doing it yourself, you might be fine on your very own.

A financial expert is not just for the super-rich; anybody facing major life transitions, nearing retirement, or feeling overwhelmed by financial choices can take advantage of professional guidance. This short article checks out the function of monetary advisors, when you may need to speak with one, and crucial factors to consider for selecting - https://www.startus.cc/company/clark-wealth-partners. A monetary expert is a skilled professional who assists clients handle their funds and make educated decisions that straighten with their life goals

Indicators on Clark Wealth Partners You Should Know

In contrast, commission-based advisors earn income via the economic items they sell, which may influence their recommendations. Whether it is marital relationship, divorce, the birth of a youngster, job adjustments, or the loss of an enjoyed one, these events have special economic effects, usually calling for timely decisions that can have lasting effects.

Report this wiki page